|

| President Muhammadu Buhari |

In a cynical, almost contemptuous manner, the Senate on Tuesday threw out President Muhammadu Buhari’s letter seeking approval for an external borrowing plan of $29.96 billion to execute key infrastructural projects within the next two years.

But it was done only on technical grounds. And to the extent that this is just the end of the introductory chapter rather than the close of the book, I will admonish the National Assembly members to be circumspect in critically examining this particular request that could, in the long run, put the nation in another bind.

|

| Nigeria Parliament |

A huge chunk of the loans was secured in the 1980s to fund what turned out to be white elephant projects. And with about $3 billion dollars spent annually just on debt servicing as at the time the write-off was concluded, the argument to exit the Paris Club by the Olusegun Obasanjo presidency was indeed very sound.

As one of the people who supported the debt write-off deal just 11 years ago, that we are engrossed in another national debate on the appropriateness of treading the same path raises serious questions about whether we ever learn any lessons from our national experience. It is even more worrying that this idea to borrow is coming at a period our capacity to meet repayment obligations is dwindling, given the crisis in the Niger Delta.

Read: John Magufuli - The Bulldozer @ One

Before going further, it is important to underscore the fact that in an economy in recession, there is need for some fiscal package to help stimulate consumption and production, create jobs and generally engender economic growth.

|

| price of food stuff multiply in the market |

One, assuming, without conceding, that there are compelling needs for some external borrowing, is it not important to first close all loopholes and drainpipes in the system; drastically restructure and rationalise government agencies and reduce the huge overhead cost that consumes a large chunk of annual budgets at all levels?

|

| let there be open government to tackle loopholes |

If we ignore all these and borrow, such funds may never be channeled into those projects highlighted by the administration and the nation would be left with nothing but huge debts to service, at very high costs.

Yes, we have been told by IMF that it is possible to get interest free loans from the international debt market but we all know that there is no free lunch anywhere, not even in Freetown.

So, it makes more sense to see the fine prints of these deals before our nation is committed, especially now that some of our lawmakers would also want a piece of the action for their “constituency projects”—another euphemism for sharing public money.

Meeting with the leadership of the senate who visited her office last week, Finance Minister, Mrs Kemi Adeosun painted a pathetic picture of our national economy.

|

| corruption is still going on |

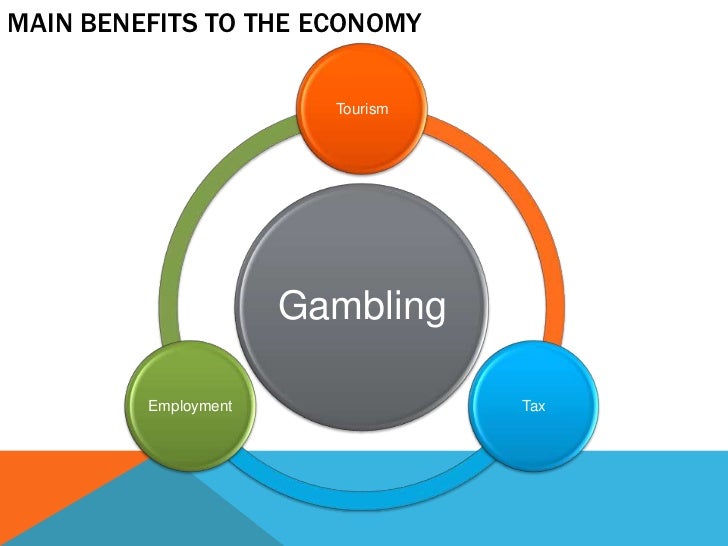

However, while I have no problem with such ‘gambling’ in national economic management, I still believe the administration is not without options.

For instance, the Minister of State for Petroleum Resources, Dr. Ibe Kachikwu also said recently that the federal government was set to sign a cash-raising oil deal with India for $15 billion. “Nigeria has a bit of a cash flow problem right now. Our reserves are not as strong as we want them” said Kachikwu who argued that because the value of the national currency is on a freefall, “what we are trying to do is to leverage on the assets we have to receive immediate cash.”

This option is particularly plausible because, even if we borrow, our only way of paying back is with our oil assets. President Buhari himself admitted as much last week. “The petroleum industry remains critical to the Nigerian economy of today and the future, despite our current challenges.

The golden era of high oil prices may not be here now, but oil and gas resources still remain the most immediate and practical keys out of our present economic crisis”, said the president at the public presentation of a roadmap on short and medium term priorities to grow Nigeria’s oil and gas industry from 2015 to 2019.

Unfortunately, the United States Energy Information Administration, (EIA) recently projected a negative downturn for the country’s crude oil production because of the militancy in the Niger Delta. In confirming the prediction, Kachikwu noted that between January and June 2016, over 1,600 incidents of vandalism were recorded.

He explained that compared to the 2.2mbpd targeted in the 2016 budget, the country currently produces 1.56mbpd showing a shortfall of about 640,000 bpd, which translates to 29.1 per cent loss.

To underscore the gravity of the situation, the NNPC Group Managing Director, Dr Maikanti Baru, also said last Friday: “Over 7000kpd of crude oil has been lost due to vandalism this year. A bulk of the loss is from JV assets.

This implies that 60 per cent of oil production lost is NNPC-FGN equity. At an estimated price of 45 dollars per barrel, the total 2016 revenue loss to the Federation Account translates to about 7 billion dollars. This loss is equivalent to a new 7,000mw power plant; new 350kpd refinery; over 30 per cent of National budget; and a new 1,700 kilometre pipeline.”

Therefore, it is difficult to fault the president that the only way forward is to grow the oil economy. But for that to happen, he has to resolve the Niger Delta problem which remains a low-hanging fruit his administration has been unwilling, until now, to pluck.

| Niger Delta Militants |

But then there are immediate challenges and that brings us back to the issue of the proposed loans.

I have been told by those who should know that embedded in the N6.08 trillion 2016 budget is a deficit financing of N2.2trillion out of which N900billion was to come from the international debt market while N984billion would be raised from the domestic market, totaling N1.84trillion.

Strictly speaking, therefore, the approval the President is seeking for about $30billion may actually be academic, though transparency requires that the terms of the borrowing be spelt out so that Nigerians can understand the full implications of what the administration is doing.

|

| Finance Building, Abuja |

“One of the technical things missing is that, the letter (from President Buhari) says. ‘attached is a draft’ but there was no attachment…there was no detail of the borrowing plan,” said Senate Leader, Ali Ndume.

Yet, if there was any notion that the lack of attaching the draft could be an oversight, it was immediately dispelled by the Presidential Liaison Officer to the National Assembly, Senator Ita Enang:

“There are certain information and details which will enable them to consider in detail, and appropriately the request of Mr. President. So we are collating that information. The Budget Office of the Federation, the Debt Management Office, the Minister of Budget and National Planning, Minister of Finance and the economic team are collating the information so that it can be submitted to the Senate to enable them take the appropriate decision.”

The implication of that statement is that it is just now that the information on loans deals worth a whopping $29.96 billion expected to be spent within the next two years would be collated!

Yet, the Debt Management Office (DMO) Director General, Dr. Abraham Nwankwo is all over the place, defending what he probably has little or no idea about. Besides, how can the DMO approbate and reprobate at the same time?

|

| DMO |

The report puts Nigeria’s outstanding debt portfolio as at December, 2015 at about US$65.43 billion compared to US$67.73 in 2014, thus representing an increase of 12 percent. And these did not include the figures for the 36 states that were not ready as at the time of compiling the report.

From my reading of the situation, this money, if secured, may buy the nation two to three years of some feel-good situation but then, what follows will be the problem of how to pay back.

|

| Taking our children back to slavery |

Indeed, to the extent that the entire loan package is more than the total external reserve of Nigeria, it looks as if the federal government is just desperate to buy itself some reprieve from an increasingly hungry (and angry) populace.

Yet, the reality remains that a government that will enter a lame duck stage in another year or so has no business contracting a debt of such magnitude.

Source(s): Thisday

Nigeria Government Gambling With $30 Billion Borrowing, Passing To The Next Generation To Pay

Reviewed by E.A Olatoye

on

November 05, 2016

Rating:

Reviewed by E.A Olatoye

on

November 05, 2016

Rating:

Reviewed by E.A Olatoye

on

November 05, 2016

Rating:

Reviewed by E.A Olatoye

on

November 05, 2016

Rating:

No comments:

Your comments and recommendations will be appreciated